Author: Oche Thomas Eluma & Raphael Ugwu

Overview

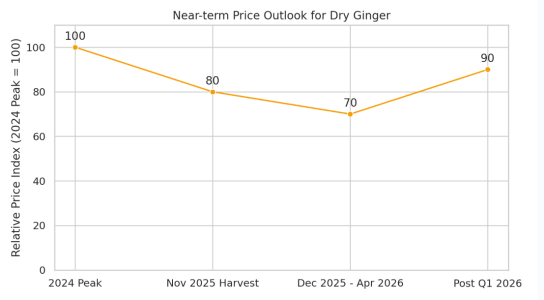

Southern Kaduna remains the heart of Nigeria’s ginger belt. The upcoming November 2025 harvest season is showing improved farm performance compared to the last two years, though production will still be constrained by seed scarcity. While disease pressure has eased, market dynamics suggest that prices will remain competitive, with dry ginger likely to see a temporary decline of 20–30% compared to last season’s peak before stabilizing again.

The shift in market behavior over the past year is also shaping farmer and trader strategies. With reduced disease pressure, many farmers are cautiously expanding their fields, but limited access to affordable, high-quality seed material remains a critical bottleneck. Meanwhile, middlemen are expected to engage in aggressive stockpiling once the new harvest hits the markets, setting the stage for a potential price rebound by early 2026. For exporters and processors, this season presents both opportunities and risks. This rewards those who can balance early procurement with disciplined inventory management.

A smallholder farmer’s ginger farm in Kagarko

The images above highlight the resilience of smallholder farmers who continue to drive ginger production in Southern Kaduna despite persistent challenges. While fields are showing stronger recovery compared to the past two years, these farms also reflect the uneven reality of this season, pockets of healthier crops alongside plots constrained by seed scarcity and varying disease management practices. This balance of progress and constraint underpins the dynamics shaping the 2025 harvest outlook.

A cross-section of photos of this year’s ginger harvest from smallholder farms in Kachia

State of the Market

- The 2023 fungal blight remains present but is less severe this year, with about 60% of farms showing healthier conditions compared to 2023 and 2024.

- Farmers continue to rely on a mix of chemical treatments (Z-Force, SAAF, Ridomil Gold, Ultimax Plus, etc.), but no one standard control method has yet been adopted.

- Smallholder farmers in Kafanchan have developed a biological solution that has proven effective against the fungal blight, showing potential for sustainable control measures.

- Despite seed scarcity, joint seedling sharing among farmers and cooperatives has not gained traction. This concept may become more important before the next planting season.

- Farmers who lost their seed stock and could not afford replacements diversified into turmeric, pepper, and grains as alternative income sources while awaiting access to ginger seedlings.

- Fresh ginger harvests have begun in Kachia, while Kagarko and Kafanchan markets are yet to see significant supply.

- Seed scarcity has limited cultivation, with many farmers unable to plant this year.

- Export demand remains steady from Europe and the Middle East due to Nigeria’s high-pungency ginger.

- Price competitiveness from China and India has reduced Nigeria’s export volumes over the past two harvest seasons.

- Expectations for export recovery in 2025 are cautiously optimistic, though stakeholder confidence remains guarded

Market Context (2024 - 2025 Reference)

- Fresh ginger peak price (2024): ₦600,000 per 60 kg bag (~USD 390).

- Dry ginger peak price (2024): ₦700,000 per 40 kg bag (~USD 455).

Outlook for November 2025 Harvest Season

- Production: Output will be higher than 2023/24, but overall supply is capped by seedling shortages.

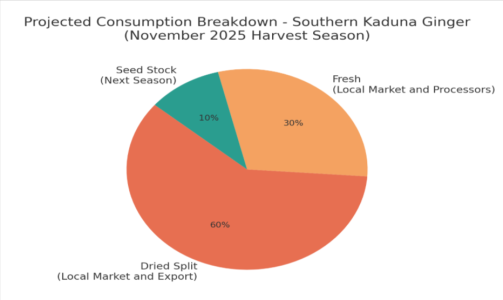

- Consumption Breakdown:

- 30% fresh ginger for local markets & processors.

- 10% saved for seed stock for the next planting season.

- 60% processed into dry split ginger for local and export markets.

- Price Forecast:

- Fresh ginger may rise gradually post-harvest but is unlikely to hit 2024 peaks.

- Dry ginger prices are expected to drop 20–30% from last season’s ₦700,000 peak, but this may be short-lived.

- Likely downtrend between Dec 2025 and Apr 2026 as supply pressure builds.

Export & Quality Outlook

- Quality this season is projected to be good for export, provided drying and grading are carefully managed.

- Local market competitiveness may discourage some exporters due to higher domestic pricing.

- Exporters who stock early stand the best chance of securing lower costs before the off-season price shift.

Risks & Challenges

- Persistent fungal blight (though less severe).

- Lack of consensus on disease control methods.

- Limited seed availability, restricting expansion.

- Narrow export price margins versus local market competition.

Key Takeaways

- Farms are healthier, but seed scarcity caps recovery.

- 40% of the harvest will be retained locally (fresh consumption + seedlings).

- Dry ginger prices will dip temporarily, but a rebound is likely post-Q1 2026.

- Exporters and traders should secure stock early and monitor evolving disease management solutions.